Inside the Round: Clay’s $100M Raise Explained

Clay just scored $100 million at a $3.1 billion valuation. Here’s what that means for the AI sales stack.

Welcome to Feed The AI’s Inside the Round!

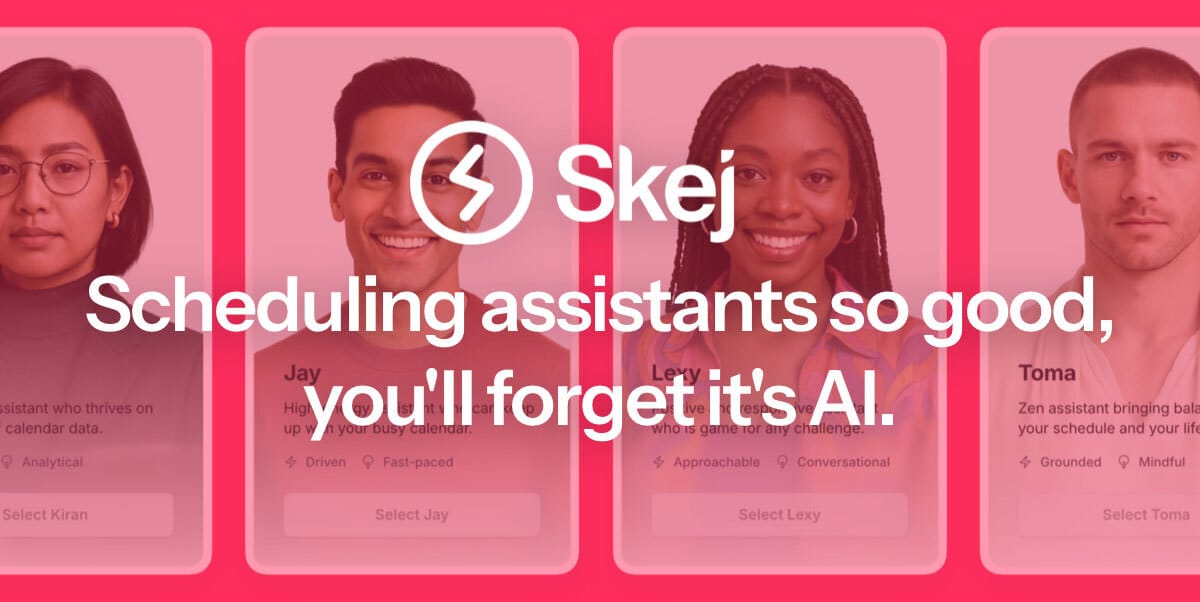

An AI scheduling assistant that lives up to the hype.

Skej is an AI scheduling assistant that works just like a human. You can CC Skej on any email, and watch it book all your meetings. It also handles scheduling, rescheduling, and event reminders.

Imagine life with a 24/7 assistant who responds so naturally, you’ll forget it’s AI.

Smart Scheduling

Skej handles time zones and can scan booking linksCustomizable

Create assistants with their own names and personalities.Flexible

Connect to multiple calendars and email addresses.Works Everywhere

Write to Skej on email, text, WhatsApp, and Slack.

Whether you’re scheduling a quick team call or coordinating a sales pitch across the globe, Skej gets it done fast and effortlessly. You’ll never want to schedule a meeting yourself, ever again.

The best part? You can try Skej for free right now.

This is a new new series where every week, we’ll take one AI company that raised funding and dissect:

Who raised & the tech behind it

Why investors are all-in

Competitive risks and what’s next

Whether you’re building, selling, or investing in AI, this is the edge you’ve been looking for.

Let’s dive in:

Who Raised?

Company: Clay

HQ: New York, NY

Round: $100M

Valuation: $3.1B

Investors: CapitalG (lead), Sequoia Capital, Meritech Capital Partners

What Do They Actually Do?

Clay automates the grunt work of sales and marketing by blending data enrichment, AI workflows, and automation.

Think: Identify prospects → Gather data → Trigger outreach → Do it all without your SDR crying over CSVs.

Their product is like Cursor for go-to-market teams: flexible, scriptable, and insanely customizable.

Their self-described core user? The “GTM Engineer”: Someone technical enough to make AI workflows sing, but focused on pipeline, not Python.

Example use case:

A logistics company used Clay to scrape warehouse data from Google Maps, cross-reference it with parking lot activity, and score which locations had the most expansion signals.

Who Invested and Why?

CapitalG (Alphabet’s growth arm): Betting on Clay as the backbone for AI-driven sales ops.

Sequoia Capital: Doubling down on the idea that GTM = code now.

Meritech: Loves SaaS infra with high stickiness and insane expansion potential.

Quote from CapitalG partner Jane Alexander:

“Clay is the only company taking an engineering approach to go-to-market.”

Translation: They’re building the platform for GTM automation, not just a point solution.

Why Now?

Sales teams are drowning in tools and data noise.

SDR headcount growth is slowing; efficiency is the new gospel.

AI is the workflow orchestrator, not just the email writer. Clay nailed this narrative early.

And the numbers:

10,000+ paying customers (including OpenAI & Google).

$100M ARR projected for 2025 (3x growth from last year).

Nearly profitable, minimal burn and investors are loving it.

Competitive Context

Clay vs. The World:

ZoomInfo: Still the data king, but its new GTM Studio is a direct shot at Clay.

Apollo.io, Cognism: Data-first players adding automation layers.

Outreach, Salesloft: Workflow incumbents, but less flexible + more siloed.

AI-native challengers: Rows of “Claygencies” (Clay-based agencies) = early ecosystem moat.

Clay’s edge?

Platform-first, community-driven (60+ user clubs globally), and customizable enough to make RevOps nerds drool.

Mini SWOT Analysis

Strengths:

Crazy product-market fit with modern GTM teams.

Deep integrations + strong early evangelism.

Weaknesses:

Complexity: “Too powerful” = learning curve.

Heavy reliance on semi-technical users (GTM engineers aren’t in every org yet).

Opportunities:

Own the “AI GTM stack” space before ZoomInfo/Apollo crush them with bundles.

Expand into self-serve workflows for non-technical marketers.

Threats:

ZoomInfo has the data advantage (Clay integrates with them now, but… coopetition gets messy).

AI commoditization. Clay needs to stay platform, not feature.

Job Signal

Clay is hiring across AI engineering, GTM strategy, and customer success. Given their ARR growth and fresh $100M, expect headcount to spike

PS we also have 🛰️ Job Radar issue coming later this week for AI specific jobs.

Think jobs that barely existed 3 years ago, but are hiring like crazy. Like Clay’s GTM engineer

Wrap up

Clay is creating a new job category (GTM engineer) and rallying an ecosystem around it. If they execute, they become the default operating system for revenue teams. If not? They’re a killer feature waiting to be acquired.

📬 Enjoyed Inside the Round?

Be on the look out for more inside the round and job radar episodes.

See you in the next episode.

Feed The AI